Key Takeaways

- Before Russia’s full-scale invasion in 2022, Ukraine was able to generate substantial revenues from the transit costs of Russian hydrocarbons destined for the European market. Despite the war, Russian oil (and some gas) continues to flow to Europe via Ukraine, and the latter continues to receive transit fees.

- In the field of hydrocarbons, although Ukraine is far from having hydrocarbon reserves equivalent to those of Russia, it has several assets to offer Europeans, including particularly large storage capacities. Fortunately, these storage facilities are located in the western part of the country, away from much of the fighting.

- Thanks to the successful synchronization of the Ukrainian and the EU power grids, the electricity trade continues. It has become a field of increased cooperation between Kyiv and Brussels, offering a potential blueprint for other sectors with a view to future integration.

- Despite the immense destruction caused by the Russian army, which specifically targeted the country’s energy infrastructure, Ukraine has shown extraordinary resilience. Ukraine can export electricity to its European partners, creating a profitable situation for both parties and good promises for the future.

- While the debate continues in Europe regarding the role of nuclear energy in the energy transition, it is already clear that in this domain, North American actors have the upper hand in Ukraine.

- Decisions made in Brussels on the exact contours of the energy transition will have a major influence on energy policy decisions made in Ukraine. The country has significant potential to produce decarbonized and renewable electricity.

Introduction

On February 24, 2022, dozens of Ukrainian technicians and engineers kept a late watch. They had the date in mind for a long time. Not that they had anticipated the Russian invasion: on February 24, the Ukrainian national energy operator, Ukrenergo, was to carry out a particularly sensitive exercise, disconnecting its electricity grid from the Russian and Belarusian grids, which have always been synchronized since the fall of the Soviet Union. This exercise had been planned between Kyiv and the European Union for a long time. Since 2014, Ukraine has aspired to leave the old Soviet power grid to synchronize with the European network, named ENTSO-E. That night, the desynchronization took place just as the first Russian tanks crossed the Ukrainian border.

Russia’s full-scale invasion of Ukraine is changing everything in Ukraine. The energy landscape, in particular, has been turned upside down. The economic model of a transit country for Russian hydrocarbons bound for Europe is likely to disappear. And the energy independence of this country, the great heir to the Soviet nuclear industry, must now move forward without its historic Russian partners. At the same time, the synchronization of Ukrainian and European power grids opens up new prospects for the country, both economically and politically, while its rapprochement with Brussels will greatly influence the energy policy choices made in Kyiv.

This report takes a three-step approach to analyzing the consequences of the war on the Ukrainian energy landscape and its international ramifications. The first step is to understand the stakes involved in the announced end to the transit of Russian hydrocarbons via Ukraine to Europe, and how it changes the country’s political economy. We will then analyze the prospects opened up by synchronizing Ukrainian and European power grids that firmly anchors Ukraine into the European Union. Finally, at a time when the possibility of a long war is now almost certain, Ukraine is thinking about renewing its nuclear fleet and the energy transition ahead.

“Defenders of Light” mural dedicated to air defence forces and power engineers on a high-rise building at 3-A Mykola Mikhnovsky Boulevard, Kyiv. (Future Publishing/Reuters)

The Changing Political Economy of a Transit Country: A Difficult Farewell to Transit Fees

Since the fall of the Soviet Union, Ukraine has inherited a strategic position and critical infrastructure. Situated between Russia, with its immense oil and gas reserves, and the European Union, the leading destination for Russian hydrocarbons, Ukraine provides the connection between these two areas. Its gas transportation system enables annual transport of up to 146 billion cubic meters (bcm) of gas to the European Union annually. However, as Russia has gradually built infrastructure to bypass it, the share of gas transiting via Ukraine has steadily decreased since the 2010s, from 65.3 percent of Russian natural gas deliveries in 2009 (92.8[1] out of 142 bcm[2]), to only 21.4 percent (38 out of 177 bcm)[3] in 2021. In the case of oil, transit via the Ukraine has always been significantly lower but remained important. In 2021, Ukraine accounted for only around one-tenth of Russian crude oil exports to the European Union (14,3 out of 137.8 million tonnes) but comprised around one-third of pipeline deliveries (out of 39 million tonnes).[4]

Unsurprisingly, what was originally meant to be a unified infrastructure within a single country became a source of tension between the producing country—Russia—for whom the delivery of hydrocarbons to its customers must be guaranteed at all costs, and transit countries such as Ukraine, for whom the passage of Russian hydrocarbons through its territory is a golden opportunity to extract substantial transit fees through the two state-owned companies Naftogaz (for gas) and Ukrtransnafta (for oil). In the case of oil, according to the latest contract between Ukrtransnafta and its Russian counterpart Transneft concluded in 2019 for the next ten years, Russians were expected to pay Ukrainians 1.5 billion euros ($1.59 billion) for the entire period, or 150 million euros a year.[5] As for gas, Ukrainian Naftogaz and the Russian Gazprom reportedly agreed on an annual transit fee of $3 billion for the 2021–2024 period and a guaranteed transit of 40 bcm.[6] However, in 2022, only 20 bcm of Russian natural gas was transported via Ukraine—meaning substantially lower revenues[7]—due to the Russian unwillingness to pay for the transit of non-delivered gas, which has already caused Naftogaz’ lawsuit.[8]

For a country with an average annual budget spending of around $29 billion in 2017–2021,[9] it is quite clear that the annual inflow of millions of dollars into the state coffers was a matter of the utmost importance to the Ukrainian state, despite the gradual decline in income over the past decade.

Ever since the demise of the Soviet Union, the highly politicized issue of transit fees has been linked to the ups and downs of Ukrainian-Russian relations. Moscow used it as a means of pressure to prevent its neighbor from getting too close to Brussels. So-called “gas wars” between Russia and Ukraine, like the ones in 2006 and 2009 when Kyiv was particularly getting closer to the European Union, punctuated the last three decades. Gas pricing has always remained highly controversial in Ukraine. Many political concessions of pro-Russian President Viktor Yanukovych (such as extending the Russian Black Sea Fleet lease in Sevastopol from 2017 to 2057) were made in exchange for discounts on imported natural gas.

Importantly, these episodes of gas wars eventually always affected Europeans, for whom ensuring a continuous supply of hydrocarbons free from political and diplomatic complications became a priority. With the backing of certain Western European business groupssuch as the German companies Wintershall, Uniper, and E.ON, the Dutch Gasunie, or the French Engie,Russia intensified its efforts to bypass transit countries like Ukraine. The Nord Stream 1 and 2 pipelines directly connecting Russia to Germany were born from that vision. Since 2014 and Russia’s annexation of Crimea, Kyiv has vigorously denounced these constructions on geopolitical grounds: From its perspective, as soon as Russian gas no longer transited through Ukraine, Moscow would not hesitate to launch a full-scale invasion against its neighbor. This view was widely shared by the post-communist Central European countries, led by Poland, who took Kyiv’s side in this dispute. But leaving aside the geopolitical argument, which in any case proved to be tragically misguided as Russia did not hesitate to invade Ukraine even before Nord Stream 2 was operational, the financial argument is far from negligible, per the figures mentioned above.

Map 1. Major Russian gas pipelines to Europe[10]

A Difficult Farewell

Did the invasion of Ukraine by Russia in February 2022 signal the end of the transit fee model? Surprisingly, not entirely. The war has certainly ended, for a very long time at least (if not forever), Russia’s massive hydrocarbon exports to Europe. And yet, as of summer 2023, Russian exports are still not entirely cut. While bombing Ukrainian territory daily, Russia continues to send (some) gas and oil through its pipelines that pass via Ukraine and therefore pays daily transit fees to Kyiv. Ukraine, for its part, takes great care not to damage the pipelines and actually receives the said transit fees: in 2022, 1.2 billion dollars for natural gas and around 150 million dollars for oil[11] which is estimated to be around $800 milion.

Although Ukraine is still counting on the rent coming from transit fees, authorities are well aware that this source may well dry up very soon. In an interview with the Financial Times, Ukrainian Minister of Energy Herman Halushchenko said that the chances of seeing the current contract with Gazprom being prolonged are so slim that Ukraine is ready for the full cut of Russian supplies starting in 2024. In practice, this may require putting out of order the existing infrastructure, since empty pipelines require expensive maintenance—all the more expensive if there is no prospect of transporting gas anytime soon.

On the Ukrainian side, however, it is not so much a sudden drop in revenues from transit fees, as the quantities of gas in transit have been falling continuously since 2019. In the last quarter of 2022, the average monthly transit volume of Russian natural gas via Ukraine was only 1.1 bcm—down from 3 bcm and 4.6 bcm in analogous periods of 2021 and 2020, respectively. The general flow during the fourth quarter of 2022 was 76 percent lower than in the fourth quarter of 2020. In other words, the Ukrainian government has been aware for several years now that income from transit fees is not only steadily declining, but also that it is an unreliable source of revenue over the long term. At the same time, as low as it gets, any source of revenues is needed in Kyiv to finance the conduct of the war.

Gas bubbles from the Nord Stream 2 leak reaching surface of the Baltic Sea in the area shows disturbance of well over one kilometre diameter near Bornholm, Denmark, September 27, 2022. Danish Defence Command/Handout via REUTERS

But suppose Russian gas and oil continued to flow to Europe. In that case, it would be mainly due to the European Union (particularly countries formerly part of the Eastern bloc such as Hungary, Slovakia, Czechia, and Bulgaria) (simply deciding that it cannot do without Russian gas from one day to the next. To this day, the European Union has not sanctioned Russian gas, but only declared that it would fully phase out Russian natural gas consumption by 2027. However, in practice, Russian gas imports have been considerably reduced following retaliatory measures from the Kremlin. Gazprom started to push for a so-called “ruble-for payments scheme,” pressuring its European contractors to open ruble accounts in Russian banks to proceed to the payment, which led to the halting of supplies and triggered commercial arbitrages with most of Gazprom’s key commercial partners in Europe. As a result, the share of Russian gas imports in overall EU consumption dropped substantially, from 31 percent in Q1 2022 to 15 percent in Q1 2023, even in the absence of European supranational restrictions.

A similar situation exists with oil, where several EU member states are still heavily dependent on Russian oil supplies flowing through Ukraine, giving the latter the opportunity to collect transit fees. In fact, in the case of oil, taking into account the need to renew damaged infrastructure, including multiple oil depots, Ukraine increased the transit fee four times since the start of the full-fledged war in 2022 from 8.6 to 21 euros per tonne.[12] The Ukrtransnafta’s total revenue for crude oil transit and capacity reservation was around $85.8 million in 2022[13].

And yet, as opposed to gas, the European Union did sanction Russian oil imports. The sixth package of sanctions imposed the phase-out of Russian crude oil imports by December 2022 and Russian oil products imported by February 2023. The effects were quick to materialize: in March 2023, the import of Russian crude oil and petroleum products to the European Union accounted for only 1.4 million tons, which was 90 percent lower than the average monthly figure of 15.2 million tons in 2019-2022.[14]

However, an exception was made to three Central European landlocked countries: Hungary, Slovakia, and Czechia.[15] All three of them heavily depend on the Russian oil delivered through the Druzhba pipeline: 50 percent for the Czech Republic,[16] 80 percent for Hungary[17] and even close to 100 percent for Slovakia. In 2022, significant amounts of oil were exported via this route to Hungary (4.9 million tons), to Czechia (4.2 million tons) and to Slovakia (5.2 million tons).[18] This should continue for the upcoming years, theoretically only until 2027, the planned end date of Russian fossil fuel exports to the EU, which will still give Ukraine the possibility to collect transit fees.

A gas pipeline valve station damaged by a shelling is seen near Balakliia, in Kharkiv region, Ukraine, September 23, 2022. REUTERS/Umit Bektas

A New Model?

Before the war, Ukrainians were afraid of Nord Stream 2 for many reasons, including the potential loss of transit fees in the future, the loss of political leverage over Russia (that Ukrainians thought could shield them from further armed aggression), but also that it would simply make Ukraine less interesting for the European Union, both from a geopolitical and economic perspective. With a process of EU enlargement largely stalled, the fear was that Europe would simply lose any interest in deepening ties with Ukraine. Eventually, the war killed two birds with one stone: it signed off the end of the transit fees model for Ukraine while irrevocably anchoring Ukraine into the European integration process, opening many more opportunities for genuine cooperation and economic integration than the rentier model of transit fees.

But when it comes to hydrocarbons, what assets could Ukraine bring to bear on Europe that is launching its energy transition? Far from being just a transit territory, Ukraine has a number of strengths it could exploit more in the future. First of all, Ukraine boasts a modest local production of natural gas. Before the full-scale Russian invasion, Ukraine produced around 20 bcm of natural gas and imported 10 bcm each year. In 2022, internal production decreased from 19.8 bcm to 18.5 bcm and internal consumption has fallen by more than 30 percent from 28.5 bcm to 19.8 bcm.[19] The country previously had the ambition to increase its internal gas production to become self-sufficient, and possibly to export part of it. For that, Ukraine possesses one of the biggest natural reserves on the continent (around 1 trillion bcm), but this resource remains badly explored.

Ukraine’s ambition of becoming a natural gas exporter may be ambitious, but the country’s political elites are serious about these plans. In June 2023, during a conference in London on Ukraine’s post-war recovery, Deputy Head of the Office of Ukrainian President Rostyslav Shurma announced that, apart from providing 10 bcm of biomethane to Europe, Ukraine will be able to export 15 bcm of natural gas in the future.[20] Some steps are being made in this direction. Even in war time, Ukrainian extractive industries are trying to develop further. Ukrainian public and private companies are building their expertise in unconventional extraction methods, such as natural gas extraction from coal beds and horizontal drilling,[21] or in new ways of exploration, like focused magnetic resonance.[22] At the end of May this year, state-owned Ukrnafta selected the list of twenty prospective fields presumably containing around 30 bcm of natural gas and 12 million tons of oil which will be proposed to potential investors. However, a lot of new prospective gas fields could be located on the shelf of the Black Sea, as it was revealed by recent Romanian[23] and Turkish[24] discoveries in their waters, or in the eastern part of the country (such as the Yuzivska shale gas fields, which before 2014 were developed by Shell but abandoned before the start of industrial production due to the proximity to the war zone[25]). It makes any substantial increase in Ukrainian domestic gas production highly dependent on the outcome of the war. Moreover, it is not certain that Western creditors would be interested in investing in new fossil fuel extractions—although that certainly should not be ruled out.

Another asset in Ukraine’s pocket is its very large underground natural gas storage capacities. Indeed, Ukraine ranks among the top-five countries in the world with the largest underground natural gas storage capacities. The Ukrainian gas system accounts for twelve large storage facilities with a total capacity of around 31 bcm (EU overall gas storage capacity is around 100 bcm,[26] total world storage capacity in 2022 is 424 bcm[27]). Roughly 25 bcm capacity is located in western Ukraine and at least 10 bcm out of that capacity could be provided to European companies to store their natural gas.[28] By September 19, 2023, Ukraine reached its planned target of accumulating 14.7 bcm of natural gas in its underground storage ahead of the deadline.[29] Last year, Ukraine started with 14.7 bcm in storage in November and used 5.6 bcm of natural gas during a rather mild winter.[30]

Cooperation in this area is already well established. Since 2017, Ukraine allows companies to store their gas in a so-called “customs warehouse” regime. It allows contractors to keep natural gas in storage for three years without paying any customs fees under the condition that later this gas will be transported again abroad and not used for the internal market. However, just after the start of the invasion, Ukraine temporarily restricted the export of all-natural gas contained in its underground storage.[31] Later, in June 2022 the restrictions remained only for natural gas of Ukrainian production,[32] but natural gas from the customs warehouse regime was again allowed to cross the border.[33] Despite that three-month temporary export ban, foreign contractors played an important role in Ukrainian underground natural gas storage in 2022. According to Naftogaz, 1,100 companies from twenty-seven countries have used its underground gas storage services.[34]

For winter 2023-2024, the EU has reached its planned gas storage target of 90 percent on August 18,[35] and as of September 21, EU gas storage is almost 94.5 percent full.[36] Experts from the International Energy Agency warned the European Union at the end of last year that next winter could be much harder due to the further diminishing Russian pipeline gas imports and the possibility of more severe weather conditions.[37] The European Union may need substantially more natural gas, which could make Ukrainian underused storage capacities a valuable asset. Ukrainian storage allows flexibility depending on demand conditions—natural gas could be resold locally: for example, in 2020, 60 percent of the gas stored by foreign companies was sold to the local market or used for the next winter.[38]

Synchronized: A Concrete Step Towards EU Integration?

Thanks to the successfully rushed synchronization of the Ukrainian and the EU power grids, electricity can now easily be traded between both sides. Importantly, this is not a one-way exchange where the European Union comes to Ukraine’s rescue by exporting electricity. On the contrary, far from being an act of charity, Ukraine’s entry into the European energy market is viewed very positively by neighboring countries—led by Poland—for whom Ukraine’s often low-carbon and cheap electricity represents a welcome opportunity amidst certain struggle to kick-start their energy transition.

However, it remains difficult for Kyiv to optimize its export potential, as the Russian army systematically bombs Ukrainian energy infrastructure. Despite this daily destruction, the country has shown remarkable resilience and has already succeeded in exporting significant quantities of electricity in 2022. Despite Kyiv’s declared ambitions to export even more, the task will prove to be more difficult in 2023. The necessary technical maintenance of nuclear power plants during summer had to be compensated by an increase in electricity imports.

Only since mid-September 2023 have electricity exports to Slovakia and Moldova been substantially larger than imports.[39] The final yearly numbers will depend on the intensity of the Russian bombardments to come.

The deepening of EU-Ukraine relations is reshaping the European energy landscape. Reciprocally, the future of Ukraine’s energy landscape will be influenced by Brussels, which is seeking to accelerate its transition to low-carbon energies. From this perspective, Ukraine already has certain cards to play by being able to provide valuable economic opportunities to supplement its call for humanitarian help.

Current Electricity Infrastructure and the Impact of the War

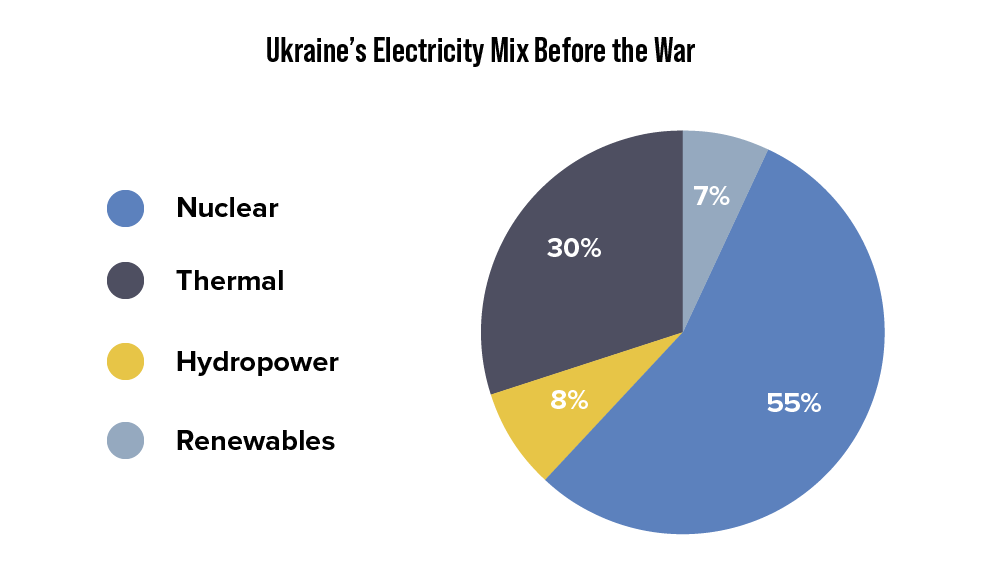

Before the war, Ukraine had a total producing capacity of around 50 GW. In comparison, Poland boasts a similar capacity with 51.8 GW in 2020, while the capacity of the entire EU amounts to 991 GW. The largest share of the electricity mix consists of nuclear energy with 55 percent. With a total of fifteen reactors in four nuclear power plants (Rivne, Khmelnytskyi, South Ukraine, and Zaporizhia) Ukraine is the seventh-largest producer of nuclear energy in the world. Since the early days of the conflict, the Russian army has occupied the Zaporizhia nuclear power plant.[40] With six reactors, it is not only Ukraine’s largest power plant, but also the largest in Europe.

Until 2014, contacts between the Ukrainian and EU electricity market remained marginal. Only one part of the Ukrainian electricity system (the so-called “Byrshtyn Island” in the western part of the country) has been connected to the European grid since 2002 and has been able to export electricity generated by a local coal-fired thermal power plant.

The Euromaidan revolution of 2014, followed by the annexation of Crimea and the beginning of the war in Donbass, profoundly changed the geopolitical position of Ukraine. Under immediate Russian threat, energy became securitized. Among other measures, in 2017 Ukraine signed an agreement with the European Union about the synchronization of their respective power grids scheduled for 2023, preceded by a series of exercises and upgrades to existing infrastructure.[41] The war has obviously disrupted this timetable and seems to have set the seal on the integration of the Ukrainian power grid into the European Union.

Synchronization is certainly good news, but the reality is that Ukraine’s energy infrastructure is constantly suffering from Russian airstrikes. During the fall of 2022, the Russian armed forces started to target critical energy and electricity infrastructure. Ukrainian Minister of Energy Herman Halushchenko said in October 2022 that 271 airstrikes had successfully hit key energy facilities. Almost half of the entire energy infrastructure is either damaged, destroyed, or occupied.[42] Ukrenergo estimates that 27 GW, which is 45 percent of the country’s installed capacity, was occupied or damaged.[43] The destruction of the country’s largest water dam in Nova Kakhovka in June 2023 was one of the largest energy infrastructure-related catastrophes of the current war and led to the loss of 0.33 GW of installed capacity.

Destroying key energy assets seems to be a twofold strategy on the Russian side. On the one hand, this was largely seen as an attempt to put civilians under pressure. Indeed, millions of Ukrainians got through the autumn and winter living with daily power cuts, up to eight hours a day in the capital Kyiv. On the other hand, the aim was also to make it as difficult as possible for Ukraine to export its electricity to the European Union.[44]

200 ton autotransformer donated by Lithuanian companies is on its way to Ukraine to assist with restoration of the Ukrainian energy system following targeted Russian attacks.(Energy Communitiy Facebook Page/Litgrid)

Western help has been crucial in the ability of Ukrainians to renew the smooth operation of their electricity system. According to data from the Ministry of Energy, as of the beginning of July 2023, Ukraine received 8,000 tons of Western equipment.[45] In November 2023, the G7 announced its support for the rebuilding of Ukraine’s energy infrastructure.[46] The G7+ Ukraine Energy Coordination Group for providing emergency assistance was established including more than twenty countries and international organizations. The European Energy Community has also established several facilities to support its members: the Ukraine Energy Support Fund, the Ukraine Support Task Force,[47] and other platforms providing pro bono legal support to Ukrainian public energy companies helping them to file their claims in international courts.[48] At the height of winter in 2022, when millions of Ukrainians could not heat properly because of the power outages, Washington also announced $25 million in assistance to help vulnerable households.[49] In addition, the Ukrainian government launched an EU-funded program to help replace conventional electricity bulbs with energy-saving LED bulbs.[50]

Another crucial Western intervention was the newly enabled import of EU electricity to Ukraine. In January 2023, after the massive Russian airstrikes, Ukraine had to import electricity from its neighbors Slovakia, Poland, and also Moldova. During summer 2023, technical maintenance of local nuclear power plants again required EU imports, which are always more expensive for Ukrainians as EU prices remain higher. Hourly import capacity for Ukraine was steadily increased from 100 MW[51] to 1100 MW[52]—an amount still insufficient for the Ukrainian government, which assesses that the country needs at least 2 GW of import capacity from the EU to compensate for the damages done by Russian airstrikes.[53] In June 2023, speaking at the gathering of the regional Three Seas Initiative, the representative of Ukraine’s Ministry of Energy announced the ambition to invest substantial funds in expanding cross-border interconnection with the European Union, enabling the possibility to export and import at an hourly capacity of 6,000 MW (6 GW), knowing that as of now, Ukraine can export less than it can import, with an hourly export capacity of 400 MW.[54]

Russia’s strategy of attacking key energy targets has recently subsided during the warm period of the year, but was resumed again in September.[55] However, the incredible resilience shown by the Ukrainian population to withstand rising electricity prices on top of power outages, and the capacity of local operators to still maintain the electricity grid afloat may push Russia to reconsider the usefulness of this tactic.

Export to the European Union: A Game Changer?

Ukraine not only managed to preserve its electricity production under heavy Russian fire, but it also managed to export a significant amount of energy to the European Union, thanks to the successful synchronization of the Ukrainian power grid with the European network ENTSO-E. This integration of Ukraine with the European Union will certainly prove to be a game changer, not only for Ukraine but also for the Europe.

Since the end of June 2022, Ukraine started to export electricity to its EU neighbors, including Poland, Slovakia, and Romania. [56] Between July and October, around 2.6 TWh[57] of electricity was exported for about 5 billion Ukrainian hryvnia (approximately €130 million).[58] Needless to say, as long as the war is ongoing, Ukraine will not be able to generate enough revenue on its own to finance its budget. However, this type of revenue, which may well be seen as a substitute for the loss of Russian transit fees, is obviously not negligible.

Overall, Ukraine’s net exports to the European Union in 2022 amounted to 4 TWh of electricity.[59] While it is far from the exports, for example, of countries like Sweden or Germany to EU member states, it remains a remarkable figure. Indeed, in a little bit more than three months, Ukraine became the third-largest non-EU exporter of electricity to the European Union following Norway and the United Kingdom.[60]

Nevertheless, the transformation of Ukraine into a powerful player in the EU market will require a substantial increase in the country’s power generation capacity. In 2021, Ukraine produced 156.6 TWh and consumed 154.8 TWh[61]. According to former Ukrainian Minister of Energy Olha Buslavets, Ukrainian electricity generation decreased by 27.5 percent and consumption by 31.5 percent in 2022,[62] meaning that Ukraine produced approximately 113.5 TWh and consumed 107.6 TWh. Ukraine is essentially making the best out a bad situation: While the war had a very negative impact on the country’s production capacity, the fall in consumption made up for it.

This means that ongoing and upcoming renovation efforts will certainly improve the situation. The Ministry of Energy was tasked to restore at least 1.7 GW of repaired capacity before the start of winter and to add another 1.2 GW before the end of the year.[63] For this purpose, it can rely on new lines of Western assistance for infrastructure renovation, with $897 million from the US and $166 million from the Ukraine Energy Support Fund.

The exact feasibility of long-term plans for the amounts of Ukraine’s electricity export to the European Union remains uncertain. In May, the Ukrainian government released a new energy strategy for 2050 with only very general ideas.[64] According to a report released by the United Nations Development Program, Kyiv plans to reach at least 9 TWh of net export and produce 176 TWh of electricity annually, without specifying when those goals would be reached.[65] Long-term visibility is all the less possible since the Russian air force will most certainly continue its targeted bombing of Ukrainian energy infrastructure.

In 2022, the damage caused by the Russian bombing eventually forced Ukrenergo to halt commercial exports. Exports resumed only in April 2023, but at a much lower level.[66] In the summer of 2023, Ukraine almost ceased its exports due to the internal needs caused by massive planned technical works on its nuclear power plants. Once the summer technical maintenance is achieved, and in case Ukraine is able to resume all of its nuclear capacities, it will be able to export much larger quantities of electricity.

However, despite this negative outlook, one variable will remain quite certain: there will always be a demand for electricity coming from the European Union. Indeed, the future increase in EU electricity consumption demand as part of its decarbonization strategy will certainly entail an increase in the export of decarbonized electricity. All existing projected scenarios—including by private actors—of EU electricity demand for 2050 envision substantial inclusion of demand for electricity generation.[67] The EU-Ukraine roadmap attached to the memorandum signed in mid-June 2023 explicitly mentions the future increase of electricity exports from Ukraine to the block.[68]

In addition to strengthening links with the energy markets of its Central European neighbors, synchronization has also increased the importance of electricity in bilateral Polish-Ukrainian relations. Warsaw—the biggest supporter of Ukraine’s quick integration into the European Union—is under pressure to accelerate its energy transition. In June 2022, energy ministers from both countries signed a memorandum to strengthen energy cooperation in Central and Eastern Europe. It announces the reconstruction of an old transnational electricity line between the Khmelnytskyi nuclear power plant and the Polish city of Rzeszow that has not been used since 1992. The line was commissioned at the end of April 2023 with an allowed trading capacity of 200 MW from Ukraine to Poland and 350 MW in the opposite direction. As Poland still heavily depends on its aging coal power plants, it can find in Ukraine a welcome additional source of cheap and often decarbonized electricity.

Additionally, the European Union’s search for external electricity providers, as illustrated by the project of a Black Sea submarine electric cable between Azerbaijan, Georgia, and Romania, further confirms that there is more than enough room for Ukraine.[69]

Legal Integration and the Role of External International Organizations

Finally, it is in the legal field that progress remains the most tangible. The integration of Ukrainian markets is a complex process, where physical measures need to be complemented with respective legislative changes. According to the Energy Community, legal integration is well underway, and there are several breakthroughs worth mentioning.[70] First of all, the 2011 European Regulation on Wholesale Energy Market Integrity and Transparency was entirely transposed into the Ukrainian law during the summer 2023.[71] The adoption of this legislation was a condition for receiving a $1.5 billion loan from the World Bank.[72] It also coincided with the presentation of an extensive Organisation for Economic Co-operation and Development study about the competition in Ukrainian electricity markets, showing the important role also played by other non-EU international organizations, especially when it comes to reforming institutions and legal frameworks,[73]

Furthermore, a bill voted on by the Ukrainian parliament in June introduces many elements to develop the market for renewable electricity.[74] So far, the existing framework meant that all renewable electricity was purchased by state-owned intermediaries at a high fixed price. This format made producers dependent on a centralized allocation of payment by state agencies which often led to financial problems. The changes introduced will provide greater market flexibility for the producers of renewable electricity by allowing them to establish direct connections with customers. Additionally, this law is also aimed at integrating Ukraine with the European clean electricity certification system, allowing it to sell clean electricity without additional procedural hurdles.

Last but not least, Ukraine’s domestic energy market is being progressively liberalized to match the market-based logic of the European Union. For that purpose, with the support of international organizations such as the European Bank for Reconstruction and Development, the International Monetary Fund, and the World Bank, the state operator Ukrenergo was corporatized (i.e., transformed into a joint stock company that remains 100 percent state-owned).[75] This maneuver reveals the expectations of international backers and European institutions such as the Energy Community, who are increasingly calling for the liberalization of entire swathes of the Ukrainian economy. Yet, it is not certain that it is entirely compatible with the conduct of a full-scale war on the national territory. In this area, the European Union and its Western partners seem to be pushing Ukraine to play a fine balancing act.

Lonely passers-by are seen emerging from an underpass at night during a snowfall during a blackout in Kyiv. (Photo by Mikhail Palinchak / SOPA Images/Sipa USA)

Preparing for the Future Despite the Fog of War

“It all depends on the war” may seem to be the only possible answer to anyone wondering about the future of Ukraine. Yet, against the backdrop of a long war, Ukrainian institutions have been changing fast, accelerated by the desire of decision-makers to reform the country according to the European Union’s demands, in the hope of future integration. This power of attraction gives the European Union unprecedented influence over policymaking in Ukraine, particularly in the energy sector. Decisions made in Kyiv on the country’s future energy policy will largely be shaped by the ecological transition that is currently being discussed in Brussels. But the European Union is not the only external player with influence: As Ukraine seeks to achieve complete decoupling from Russia as quickly as possible, North American nuclear companies are playing a crucial role.

The Long Road to Decarbonization

In early 2022, when the Russian army launched its full-scale invasion, renewable electricity generation was the fastest-growing sector of Ukraine’s energy production. In 2021, Ukrainian producers generated 12.8 TWh of renewable electricity which accounted for 8.1 percent of the country’s total generation. Renewable energy production came from solar power (56 percent), wind power (33 percent), biomass, and biogas (8 percent), as well as small hydropower (3 percent).[76] Yet, what these numbers do not show is that Ukraine has been largely underperforming when it comes to renewables. According to the International Organization of Renewable Energy, considering local natural conditions, Ukraine could theoretically produce the equivalent of 200 GW of wind energy and 70 GW of solar energy[77]—five times more than its current total installed capacity. Obviously, the war in Ukraine heavily damaged and diminished renewable energy production capacities, down 36 percent, with nearly 75 percent of wind and 20 percent of solar generation lost, and all the construction projects are now put on hold.[78]

As part of the pre-war dynamism in renewables, hydrogen received particular attention. The European Union had fully integrated its Ukrainian neighbor into its major “green” hydrogen production plans.[79] Indeed, hydrogen is seen in Brussels as part of an energy transition solution and the relevant legislation for its future production and usage is now being debated at the European Parliament.[80] In this vision, non-EU countries are also called upon to play an important role, which confers to the European Union a great power to steer the energy policies of its neighboring partners, including Ukraine.[81]

Behind the voluntarism of the European Commission, there is also Germany and its “H2 Initiative,” which sees hydrogen as a future solution for its highly energy-intensive and export-oriented industry. Before the start of the full-fledged war, Ukraine was included by the business association Hydrogen Europe in its ambitious plans for European industry as an important import destination.[82] Germany officially promised to launch a fund for investing in Ukraine’s green hydrogen production[83]—a promise largely interpreted as partial compensation for the German decision not to stop the Nord Stream 2 project in 2021.[84]

Unfortunately, the war interrupted virtually all the existing hydrogen energy projects. Despite this state of affairs, hydrogen continues to be included in the perspective of Ukrainian (green) post-war reconstruction. In early 2023, Ukraine signed a memorandum with the European Union about the developments and trade of decarbonized gases,[85] although without agreeing on a precise and quantified target. Vice-President of the European Commission in charge of the EU Green Deal, Frans Timmermans, shared a policy brief dubbed “Timmermans Recovery Plan,” that suggests, among other things, the following: to integrate Ukraine into the “EU Electrolyser Partnership” launched in the summer last year,to achieve ambitious construction projects such as the EU H2 Corridor Initiative to allow Ukraine to export more hydrogen, and to decarbonize the Ukrainian steel industry using hydrogen,[86] This recovery plan envisions the redirection of 3-4 GW of nuclear capacity for hydrogen production for the European Union.[87]

Despite these laudable ambitions, the situation is currently not very promising. Almost all the emerging pilot projects were put on hold due to safety concerns.[88] According to the Ukrainian Hydrogen Council, the European Union could consider providing financing to the two hydrogen valleys[89] located in distant places from the war frontline and close to EU borders: in the Zakarpattya oblast and the southern part of the Odessa region near the Black Sea’s shore of Romania,[90] Their total installed electrolyze capacity should account for 2.5 GW:one-quarter of the possible 10 GW capacity discussed as Ukraine’s potential share in the European Union’s import. However, as for now, only the Odessa hydrogen valley has publicly announced commercial developers and details about its construction.[91]

In relation to hydrogen, another prospective venue of cooperation in the area of decarbonized gases is biomethane. The REPowerEU program launched in response to the full-scale invasion envisions an internal European biomethane production of 35 bcm, knowing that in 2021 only 3.5 bcm of biomethane was produced in the European Union.[92] Based on current and potential capacities of Ukraine—8-9 bcm expected for 2030—Ukraine could play an essential role.[93] Although the production of biomethane in Ukraine only started this year, there are currently 73 biogas plants[94] with a total production capacity of 275.9 MW before the start of the war.[95] There was already some progress being made in this direction: The first Ukrainian biomethane plant with an annual capacity of 3 million cubic meters was already connected to the grid in April 2023 in the Chernihiv region.[96] European traders have already expressed their interest in reselling Ukrainian biomethane: the Dutch trader STX signed a memorandum with several Ukrainian companies.[97] As a result of these regulatory developments, Ukraine looks for the commissioning of ten biomethane plants during 2023–2024.[98]

On the legal side, the development of biomethane is ahead of hydrogen. In 2021, the Ukrainian parliament already adopted a legal framework about the certification of biomethane deliveries.[99] However, as for now, the export of biomethane is restricted similarly to natural gas due to strategic energy security concerns.[100] Moreover, the legal basis for hydrogen production and export remains underdeveloped. Ukraine elaborated a Roadmap for Hydrogen Development in 2021 and has since been working on its national hydrogen strategy in consultation with key stakeholders.[101] However, the reality is that the European Union itself has yet to finalize its roadmap for hydrogen, and it remains a largely untested technology in Europe and elsewhere in the world.

Developing the Nuclear Industry: Between Russian Dependence and Russian Bombing

The further development of the domestic nuclear industry is seen by the Ukrainian government as key to the country’s decarbonization strategy. The increase of internal production capacity is also an essential precondition for ensuring stable exports to the European Union. The war had a profound impact on the Ukrainian nuclear industry: On the one hand, since the Russian occupation of the Zaporizhia power plant and its six reactors, the country has been deprived of its largest nuclear power plant (the largest in Europe). On the other hand, the local nuclear industry can no longer rely on its historic Russian suppliers, and going without them from one day to the next is far from an easy task. Despite the challenging environment, Ukrainian state policies concerning the nuclear industry essentially pursue two goals: to increase the production capacity by 70 percent to 24 GW by 2040 and to secure its nuclear fuel supplies.[102]

Map 2. Ukrainian nuclear power stations[103]

To increase its production capacity, Ukraine will have to renew almost all of the aging nuclear fleet it inherited from the Soviet Union. By 2040, thirteen out of fifteen of the current Ukrainian nuclear reactors should be out of exploitation, knowing that their life cycle was already extended earlier after technical upgrading. According to Energoatom’s CEO Petro Kotin, Ukraine will need to launch the construction of fourteen new nuclear reactors before 2040.[104]

In this perspective, Ukraine’s main partner to achieve its strategic nuclear ambitions is the US-based Westinghouse Electric. In 2021, Energoatom and Westinghouse signed an agreement for the construction of two new reactors at the Khmelnytsky nuclear power plant.[105] It was part of the broader program of installing five AP1000-type reactors in Ukraine with a capacity of 1.1 GW each. The plans were later extended to nine reactors.[106] The estimated cost of the installation of one such reactor is $5 billion. The Export-Import Bank of the United States will assist in financing the project.[107] According to Energoatom, financing of the two reactors to be built first will be split 85 percent-15 percent between the US Export-Import Bank and Energoatom.[108] The financing structure of the other planned reactors still remains unclear. Without disclosing any details regarding their progress, Energoatom stated that construction on these newly commissioned nuclear power plants are still ongoing despite the war.[109]

In addition to traditional nuclear technologies, Ukraine is planning to start building small modular reactors—another emerging technology—with the first pilot project in Ukraine planned to go on-site in 2029.[110] The main partner in this project is the American Holtec International, but Energoatom also keeps an advanced contact with the British Rolls-Royce, with whom a memorandum of understanding was signed in March 2023.[111]

Securing a complete nuclear fuel cycle is another big challenge for Ukraine. Indeed, the Soviet legacy also means that most of the nuclear fuel was supplied by Russian actors, up until 2022. Since Kyiv gave away the nuclear arsenal it inherited from the Soviet Union as part of the Budapest Memorandum of 1994, it could not perform the enrichment of uranium independently and had to rely on Russian partners.

Nevertheless, Ukraine has recently made substantial progress in weaning off these dependencies. Firstly, the storage site for nuclear waste in the Chornobyl exclusion zone, operated by Holtec International, has been functioning since April 2022, after briefly being occupied by Russian troops.[112] By storing nuclear waste domestically, Ukraine will not need the services of Russian companies in this domain.

Secondly, to secure their supply of enriched uranium, Energoatom signed a contract with the British company Urenco in 2019 on enriched uranium products supply.[113] Time may indeed be running out: While the war has pushed for the final decoupling from Russia, Ukraine needs to secure new suppliers within two years, after which the country will have exhausted its fuel reserves.[114] In April 2023, Energoatom finalized its rapprochement with the Canadian company Cameco, who will process and enrich Ukrainian uranium before sending it back to the Ukrainian nuclear power plants—replacing the historical Russian partner TVEL, a subsidiary of Rosatom, in this process. Indeed, Ukraine possesses the largest uranium reserves in Europe, located in the Kirovohrad region and operated by the state-owned company Skhid GZK (affiliated to Energoatom since 2019). The processing of Ukrainian uranium dioxide can cover one-third of domestic needs for nuclear fuel.

Another key improvement in the Ukrainian nuclear industry is the transfer of technology from Westinghouse to Energoatom to be able to produce nuclear fuel components (the heads and shanks of the fuel cartridge) for local Soviet reactors. The production will take place in the Westinghouse plant of Vasteras (Sweden) and will concern the VVER-1000 reactors, which had already been using nuclear fuel components supplied by Westinghouse for a couple of years and not the Russian historical supplier.[115] However, this diversification has so far concerned only the VVER-1000 reactors, which means that Russian companies are still the only existing supplier for the VVER-440 reactors, at least until 2026, when Ukrainian authorities expect to be able to cover their needs domestically.[116]

Once again, Ukraine finds itself in a situation where, although it is eager to cut all ties with Russia overnight, the material and technical reality means that this is not immediately possible. Decoupling from Russia already began in 2014, as illustrated by the partnership forged with Westinghouse several years ago. With Holtec International, it is clearly American players who are accompanying Ukraine in its desire to decouple from Russia in the nuclear sector.[117]

The role of the European Union in the development of nuclear power in the region remains uncertain for the time being, since the debate on the future of nuclear power and its role in the ecological transition is still ongoing, with a coalition of countries led by Germany who refuse to rely on nuclear power as part of the energy transition. However, other member states, including France, a civil and military nuclear power, and countries who are also using Soviet technologies (such as the Czech Republic and Hungary), are still relying heavily on civil nuclear power and count on it for their future.[118] Moreover, despite the anti-nuclear position of a couple of European member states, recent EU policy decisions on sustainable finance framework still open the door for the nuclear sector to attract financial support from investors in the future.[119]

Kyiv, Ukraine.- In photos taken on September 29, 2023, NATO Secretary General Jens Stoltenberg (left) met with the President of Ukraine, Volodimir Zelensky (right) in Kiev, Ukraine. Stoltenberg agreed to ask alliance members to provide the air defense systems necessary to protect power plants and energy infrastructure from Russian bombs and drones. (Reuters)

Conclusion

The war marked the end of a politico-economic model specific to Ukraine: politically neutral, it was able to generate substantial revenues from the transit costs of Russian hydrocarbons destined for the European market. Surprisingly, if this ambiguous Ukrainian position is fundamentally doomed to disappear, the war has not yet entirely caused the decoupling: Russian oil (and some gas) continues to flow to Europe via Ukraine, which continues to receive transit fees. Ukraine’s future as a transit country really depends solely on the Europeans. It seems that as long as they import Russian hydrocarbons, war or not, Ukraine will ensure their transport and will not hesitate to levy transit duties.

In the field of hydrocarbons, although Ukraine is far from having hydrocarbon reserves equivalent to those of Russia, it has a number of assets to offer to Europeans, including particularly large storage capacities, fortunately located in the western part of the country. Additionally, the country could potentially increase its hydrocarbon production capacity, to the point of becoming independent, but this prospect depends as much on the war as on the upcoming energy transition.

Thanks to the successful synchronization of the Ukrainian and the EU power grids, electricity can and has been traded. It has become a field of increased cooperation between Kyiv and Brussels, offering a potential blueprint for other sectors with a view to future integration. Moreover, despite the immense destruction caused by the Russian army, which specifically targeted the country’s energy infrastructure, Ukraine has shown extraordinary resilience, to the point of being able to export electricity to its European partners, creating a profitable situation for both parties and good promises for the future.

While the debate continues in Europe as to what must be the role of nuclear energy in the energy transition, it is already clear that in this domain, North American actors have the upper hand in Ukraine. Ukraine’s nuclear fleet offers guaranteed supply and attractive production potential, but its renewal and safety in wartime represent major challenges. Decisions taken in Brussels on the exact contours of the energy transition will have a major influence on energy policy decisions taken in Ukraine, who has a great potential to produce decarbonized and renewable electricity.

The views expressed in this article are those of the author alone and do not necessarily reflect the position of the Foreign Policy Research Institute, a non-partisan organization that seeks to publish well-argued, policy-oriented articles on American foreign policy and national security priorities.

[1] Simon Pirani, Jonathan Stern, Katja Yafimava, “The April 2010 Russo-Ukrainian gas agreement and its implications for Europe,” Oxford Institute of Energy Studies, June 2010, https://www.oxfordenergy.org/publications/the-april-2010-russo-ukrainian-gas-agreement-and-its-implications-for-europe-2/.

[2] Vladimir Soldatkin, “Gazprom lowers 2010 Europe gas export forecast,” Reuters, June 22, 2010, https://www.reuters.com/article/gazprom-exports-idUSLDE65L1AS20100622.

[3] “With focus on 2021, an extraordinary year on the European and global gas markets,” Quarterly report on European gas markets 14, no. 4 (2021), 14-15, https://energy.ec.europa.eu/system/files/2022-04/Quarterlypercent20reportpercent20onpercent20Europeanpercent20gaspercent20markets_Q4percent202021.pdf.

[4] “Russian Crude Oil Tracker,” Bruegel, June 15, 2023, https://www.bruegel.org/dataset/russian-crude-oil-tracker.

[5] “Transneft za 10 let zaplatyt Ukrtransnafte 1.5 mlrd evro za prokachky nefti po Ukraine,” Interfax.ru, December 5, 2019, https://www.interfax.ru/business/686862.

[6] Oleksii Orzhell, “Domovlenosty pro transit gazy – chy zberezheni interesy Ukrainy,” Ekonomichna Pravda, December 24, 2019, https://www.epravda.com.ua/columns/2019/12/24/655247/.

[7] “Russian gas transit through Ukraine fell to a historic low of 20 bcm in 2022,” Expro Consulting, January 3, 2023, https://expro.com.ua/en/tidings/russian-gas-transit-through-ukraine-fell-to-a-historic-low-of-20-bcm-in-2022.

[8] “Naftogaz initiates new arbitration proceeding against Gazprom,” Naftogaz Group, September 9, 2022, https://www.naftogaz.com/en/news/new-arbitration-proceeding-against-gazprom.

[9] “Ukraine: Government spending, in dollars,” The Global Economy, 2022, https://www.theglobaleconomy.com/Ukraine/government_spending_dollars/.

[10] Samuel Bailey, “Map of the major existing and proposed russian natural gas transportation pipelines in Europe,” 771 x 807 (211 KB) November 15, 2009, https://de.m.wikipedia.org/wiki/Datei:Major_russian_gas_pipelines_to_europe.png.

[11] Ihor Orel, “Kinets dohovoru. Urkaina nareshti ne bude postachaty rosiyskiy gaz do Evrooy, khocha vtratyt’ $1.4 mlrd. Rossiya – u pyat’ raziv bilshe,” Forbes Ukraine, October 31, 2023, https://forbes.ua/money/kinets-dogovoru-ukraina-nareshti-ne-bude-postachati-rosiyskiy-gaz-do-evropi-khocha-vtratit-14-mlrd-rosiya-v-5-raziv-bilshe-31102023-16970.

[12] Ihor Maskalevych, “Balada pro kvolu ‘Druzhbu,’” Dzerkato Tyzhnia, July 14, 2023, https://zn.ua/ukr/energetics/balada-pro-kvolu-druzhbu.html.

[13] “Dokhody operatora transportnoi systemy,” Portal Danykh Vydobuvnoi Haluzi Ukrainy, https://eiti.gov.ua/transportuvannya/dohodi-operatora-transportnoyi-sistemi/.

[14] “Mar ’23: EU slashes Russian oil; emergency stocks up,” Eurostat, June 19, 2023, https://ec.europa.eu/eurostat/web/products-eurostat-news/w/ddn-20230619-3.

[15] “Russia’s war on Ukraine: EU adopts sixth package of sanctions against Russia,” European Commission, June 3, 2022, https://ec.europa.eu/commission/presscorner/detail/en/ip_22_2802.

[16] Krzysztof Debiec, “The TAL is expanding: the Czech Republic is gaining independence from Russian oil supplies,” OSW, December 7, 2023, https://www.osw.waw.pl/en/publikacje/analyses/2022-12-07/tal-expanding-czech-republic-gaining-independence-russian-oil.

[17] Krisztina Than and Boldiszar Gyori, “Hungary agrees on option for more Russian gas shipments, oil transit fees,” Reuters, April 11, 2023, https://www.reuters.com/business/energy/hungary-agrees-option-more-russian-gas-shipments-oil-transit-fees-2023-04-11/.

[18] Vasiliy Milkin, “Truboprovodnyj eksport nefti v Evropu vyros na 7percent blagodarya Vengrii i Czechii,” Vedomosti, January 15, 2023, https://www.vedomosti.ru/business/articles/2023/01/16/959103-eksport-nefti-v-evropu-viros.

[19] Denys Staji, “Yak Ukraina zmozhe staty eksporterom pryrodnogo gazu,” Biznes Censor, February 17, 2023, https://biz.censor.net/resonance/3400201/yak_ukrayina_moje_staty_eksporterom_gazu.

[20] “Ukraina v maibutnomu planuye znachno zbilshyty eksport energii i gazu,” Ukrinform, June 21, 2023, https://www.ukrinform.ua/rubric-economy/3726030-ukraina-v-majbutnomu-planue-znacno-zbilsiti-eksport-energii-ta-gazu.html.

[21] Denis Staji, “Як Україна може стати експортером газу,” Biz Censor, February 17, 2023, https://biz.censor.net/resonance/3400201/yak_ukrayina_moje_staty_eksporterom_gazu.

[22] Evgeniy Solodkiy, Artem Kutsolap, Lutfi Ablyakimov and Sergey Megidey, “DTEK Oil&Gas and Weatherford were first in Europe to use Focused Magnetic Resonance technology,” DTEK Oil&Gas, https://oil-gas.com.ua/articles/DTEK-OilGas-and-Weatherford-were-first-in-Europe-to-use-Focused-Magnetic-Resonance-technology.

[23] Szuszanna Szabo and Russell Searancke, “Largest in decades: OMV Petrom hits a hat-trick with new crude oil discoveries,” Upstream Online, October 22, 2022, https://www.upstreamonline.com/exploration/largest-in-decades-omv-petrom-hits-a-hat-trick-with-new-crude-oil-discoveries/2-1-1466631.

[24] Ali Kucukgocmen and Ezgi Erkoyun, “Turkey’s natural gas find in Black Sea now comes to 710 bcm –Erdogan,” Reuters, December 26, 2022, https://www.reuters.com/business/energy/turkeys-natural-gas-found-black-sea-now-comes-710-bcm-erdogan-2022-12-26/.

[25] Mark Raczkiewycz, “Shell pulls out of east Ukraine gas exploration project,” Kyivpost, June 11, 2015, https://www.kyivpost.com/post/10634.

[26] Ilaria Conti, “All eyes on gas storage,” Florence School of Regulation, July 25, 2022, https://fsr.eui.eu/the-role-of-gas-storage/.

[27] Laïla Losson, “Underground Gas Storage in the World – 2022 Status,” CEDIGAZ, December 7, 2022, https://www.cedigaz.org/underground-gas-storage-in-the-world-2022-status/.

[28] “Zakachuvannia gazu do PSG zavdiaky yevropeitsiam zroslo do naivyschchoho rivnia z 2020 r,” ExPro Consulting, July 10, 2023, https://expro.com.ua/statti/zakachuvannya-gazu-do-psg-zavdyaki-vropeycyam-zroslo-do-nayvischogo-rvnya-z-2020r.

[29] “Ukraine hits gas storage target of 14.7 bcm ahead of schedule,” Ukrinform, September 19, 2023, https://www.ukrinform.net/rubric-economy/3763139-ukraine-hits-gas-storage-target-of-147-bcm-ahead-of-schedule.html.

[30] Liya Ilchenko, “Zapasy gazu u skhovyschchakh Ukrainy z bereznia zrosly lysche na 1.5 mlrd kubometriv – MEA,” Ekonomichan Pravda, July 19, 2023, https://www.epravda.com.ua/news/2023/07/19/702356/.

[31] Stuart Eliot, “Ukraine bans export of gas, including volumes held in Ukrainian storage: UkrTransGaz,” S&P Global Commodity Insights, March 3, 2022, https://www.spglobal.com/commodityinsights/en/market-insights/latest-news/natural-gas/030322-ukraine-bans-export-of-gas-including-volumes-held-in-ukrainian-storage-ukrtransgaz.

[32] Max Hunder and Nataia Zinets, “Kyiv suspends exports of Ukrainian gas, coal and fuel oil,” Reuters, June 13, 2022, https://www.reuters.com/business/energy/kyiv-suspends-exports-ukrainian-gas-coal-fuel-oil-2022-06-13/.

[33] “Restrictions on export of natural gas of Ukrainian origin does not affect the operation of the UGSs,” Ukrtransgas, June 14, 2023, https://utg.ua/en/utg/media/news/2022/restrictions-on-export-of-natural-gas-of-ukrainian-origin-does-not-affect-the-operation-of-the-ugss.html.

[34] “Natural Gas Storage,” Naftogaz Group, https://www.naftogaz.com/en/business/natural-gas-storage-business-unit.

[35] Akos Losz and Ira Joseph, “Ukraine’s Underused Gas Storage Capacity,” Center on Global Energy Policy at Columbia SIPA, May 30, 2023, https://www.energypolicy.columbia.edu/ukraines-underused-gas-storage-capacity/ ; Tidey, Alice. EU to reach winter gas storage target months ahead of new deadline. Euronews, August 17, 2023.

[36] “ASGI Storage Inventory,” GIE Aggravated Gas Storage Inventory, https://agsi.gie.eu/

[37] Kate Abnett, “EU could face gas shortage next year, IEA warns,” Reuters, December 12, 2022, https://www.reuters.com/business/energy/eu-could-face-30-bcm-gas-shortage-next-year-iea-says-2022-12-12/.

[38] Losz and Joseph, “Ukraine’s Underused Gas Storage Capacity,” Cener on Global Energy Policy at Columbia SIPA, May 30, 2023, https://www.energypolicy.columbia.edu/ukraines-underused-gas-storage-capacity/.

[39] “Tyzhnevyj eksport elektoenergii Ukrainyu perevyschchyv import v 10 raziv,” Ukrayinska Enerhetyka, September 18, 2023, https://ua-energy.org/uk/posts/tyzhnevyi-eksport-elektroenerhii-ukrainoiu-perevyshchyv-import-u-10-raziv.

[40] Since Septemer 2023, the Zaporizhia nuclear power plant is not producing electricity. Five of its reactors are in ‘cold shutdown’ and only one is in the state of ‘hot shutdown.’ Some connection to the reserve electricity grids is maintained to cover the plant’s internal needs.

[41] “Electricity transmission system operators of the ENTSO-E Continental Europe Region sign agreements on the Conditions for Future Interconnections with Ukraine and Moldova,” ENTSO-E, July 7, 2017, https://www.entsoe.eu/news/2017/07/07/entsoe-ce-agreement-conditions-future-grid-connections-with-ukraine-moldova/.

[42] Ministry of Energy of Ukraine, “Taryfy na elektroenerhiyu dlya naselennya do kintsya roku ne pidvyschchyvatymutsia – German Galuschchenko,” Cabinet of Ministers of Ukraine, June 2, 2023, https://www.kmu.gov.ua/news/taryfy-na-elektroenerhiiu-dlia-naselennia-do-kintsia-roku-bilshe-ne-pidvyshchuvatymutsia-herman-halushchenko.

[43] “Cooperation for Restoring the Ukrainian Energy Infrastructure project: Task Force. Ukrainian energy sector evaluation and damage assessment – X (as of May 24, 2023),” International Energy Charter, May 24, 2023, 4. https://www.energycharter.org/fileadmin/DocumentsMedia/Occasional/2023_05_24_UA_sectoral_evaluation_and_damage_assessment_Version_X_final.pdf.

[44] Evelin Szoke, “Ukraine halts electricity exports to Europe due to Russian missile strikes,” CEENERGY NEWS, October 12, 2022, https://ceenergynews.com/ukraines-energy-future/ukraine-halts-electricity-exports-to-europe-due-to-russian-missile-strikes/.

[45] “Ukraina otrymala ponad 8 tysiach tonn enerhetychnoho obladnannya vid partneriv z 31 krainy,” Ministry of Energy of Ukraine, June 28, 2023, https://www.mev.gov.ua/novyna/ukrayina-otrymala-ponad-8-tysyach-tonn-enerhetychnoho-obladnannya-vid-partneriv-z-31-krayiny.

[46] Humeyra Pamuk & Sabine Siebold, “G7 to coordinate help for reconstruction of Ukraine’s energy sector,” Reuters, November 4, 2022, https://www.reuters.com/world/g7-agreed-need-coordination-mechanism-repair-ukraine-infrastructure-2022-11-04/.

[47] “Ukraine Energy Support Activities,” Energy Community Secretariat, https://www.energy-community.org/Ukraine/overview.html.

[48] “Secretariat launches platform for pro bono legal support to public energy companies in Ukraine,” Energy Community Secretariat, July 19, 2023, https://www.energy-community.org/news/Energy-Community-News/2023/07/19.html.

[49] “Ambassador Linda Thomas-Greenfield Announces $25 Million for Winterization Assistance for Ukraine,” U.S. Embassy in Ukraine, November 8, 2022, https://ua.usembassy.gov/ambassador-linda-thomas-greenfield-announces-25-million-for-winterization-assistance-for-ukraine/.

[50] “EU-supported campaign to replace incandescent light bulbs with LEDs launched in Ukraine,” EU Neighbors East, January 31, 2023, https://euneighbourseast.eu/news/latest-news/eu-supported-campaign-to-replace-incandescent-light-bulbs-with-leds-launched-in-ukraine/.

[51] “Commercial exchanges of electricity with Ukraine/Moldova to start on 30 June,” ENTSO-E, June 28, 2022, https://www.entsoe.eu/news/2022/06/28/commercial-exchanges-of-electricity-with-ukraine-moldova-to-start-on-30-june/.

[52] “Press Release: Further increase in the trade capacity with the Ukraine/Moldova power system,” ENTSO-E, June 21, 2023, https://www.entsoe.eu/news/2023/06/21/press-release-further-increase-in-the-trade-capacity-with-the-ukraine-moldova-power-system/.

[53] “Ukraina potrebuye rozshyrennia importy elekroenergii z ES – Shmygal,” Ukrainform, February 2, 2023, https://www.ukrinform.ua/rubric-economy/3664193-ukraina-potrebue-rozsirenna-importu-elektroenergii-z-es-smigal.html.

[54] “Rozvytok elektrychnykh merezh ye sferoyu spilnykh interesiv krain-uchasnyts Initsiatyvy triokh moriv,” Ministry of Energy of Ukraine, April 27, 2023, https://mev.gov.ua/novyna/rozvytok-elektrychnykh-merezh-ye-sferoyu-spilnykh-interesiv-krayin-uchasnyts-initsiatyvy.

[55]Suriya Evans-Pritchard Jayanti, “Russia resumes bombing campaign of Ukraine’s civilian energy infrastructure,” Atlantic Council, https://www.atlanticcouncil.org/blogs/ukrainealert/russia-resumes-bombing-campaign-of-ukraines-civilian-energy-infrastructure/.

[56] “Commercial exchanges of electricity with Ukraine/Moldova to start on 30 June,” ENTSO-E, June 28, 2022, https://www.entsoe.eu/news/2022/06/28/commercial-exchanges-of-electricity-with-ukraine-moldova-to-start-on-30-june/.

[57] Oleksii Pavlysh, “Ukraina vidnovlye eksport elektroenergii,” Ekonomichna Pravda, April 7, 2023, https://www.epravda.com.ua/news/2023/04/7/698915/.

[58] NPC Ukrenergo, “The total cost of access to interstate power grids in the direction of Slovakia and Romania sold at Ukrenergo auctions from June 30 to October 9, 2022, amounted to more than 4.9 billion hryvnias,” Facebook, October 9, 2022, https://www.facebook.com/npcukrenergo/posts/pfbid02Aqm6D6rdKqjYC15urNmynx3hgmnBoGW4GAfTZpfuxwgv1Xg1eAKH2t8hdU9PP1tml.

[59] Market Observatory for Energy of the European Commission, “With focus on price developments in 2022,” Quarterly report on European electricity markets 15, no. 4, 2022, https://energy.ec.europa.eu/system/files/2023-05/Quarterly Report on European Electricity Markets Q4 2022 v2C_0.pdf

[60] Ibid, 32.

[61] “Ukraina v 2021 rotsi zbilshyla vyribnytstvo elektroenergii na 5.2percent, spozhyvannia – na 5.7percent – ogliad,” Interfax-Ukraine, January 11, 2022, https://interfax.com.ua/news/greendeal/790844.html.

[62] Olga Buslavets, “The last publication of my traditional summaries of the week coincided with the anniversary of the beginning of a full-scale war, and I recalled the main events and tests in energy during this extremely difficult year,” Facebook, https://www.facebook.com/olhabuslavets/posts/pfbid02noD1E28xYNKooTjvivktbnBDDVBrGKPcjAfexPcn23w8S8tvPfeggrTLopT9Yuvml.

[63] “Government allocates funds to restore energy sector before heating season – Ukraine’s PM,” Ukrinform, July 30, 2023. https://www.ukrinform.net/rubric-economy/3742335-govt-allocates-funds-to-restore-energy-sector-before-heating-season-ukraines-pm.html.

[64] “Ukraina – energetychnyj khab Yevropy. Uriad skhvalyv Energetychnu strategiyu do 2050 roku,” Ministry of Energy of Ukraine, May 1, 2023, https://mev.gov.ua/novyna/ukrayina-enerhetychnyy-khab-yevropy-uryad-skhvalyv-enerhetychnu-stratehiyu-do-2050-roku?fbclid=IwAR0eiSk1cBF8iak4qsHzx3ioGMnprLK548zK3MrsEHF37C8D7-4C3a4SxKM

[65] United Nations Development Program, “Toward a Green Transition of the Energy Sector in Ukraine: Update on Energy Damage Assessment,” UNDP, June 2023, 7, https://ceuedu-my.sharepoint.com/personal/laffitte_thomas_phd_ceu_edu/Documents/- https:/www.undp.org/sites/g/files/zskgke326/files/2023-06/undp-ua-energy-damage-assessment.pdf.

[66] Aleksandar Vasovic, “Ukraine resumes electricity exports to Europe – minister,” Reuters, April 11, 2023, https://www.reuters.com/business/energy/ukraine-resumes-electricity-exports-europe-minister-2023-04-11/

[67] “Regional insight – EU, British Petroleum,” bp, 1 February 2023, https://www.bp.com/en/global/corporate/energy-economics/energy-outlook/country-and-regional-insights/european-union-insights.html; “Transformation of Europe’s power system until 2050: Including Specific Considerations for Germany,” McKinsey, October 2010, https://www.mckinsey.com/~/media/mckinsey/dotcom/client_service/epng/pdfs/transformation_of_europes_power_system.ashx; Alex Schmitt, “EU Energy Outlook 2050: How will the European electricity market develop over the next 30 years?” Energy Brainpool, April 11, 2022, https://blog.energybrainpool.com/en/eu-energy-outlook-2050-how-will-the-european-electricity-market-develop-over-the-next-30-years/.

[68] “Ministerstvo Energetyky ta Yevrokomissiya onovyly prohramu dij u sferi energetyky na 2023 rik,” Ministry of Energy of Ukraine, June 12, 2023, https://www.mev.gov.ua/novyna/minenerho-ta-yevrokomisiya-onovyly-prohramu-diy-u-sferi-enerhetyky-na-2023-rik.

[69] “Statement by President von der Leyen at the signing ceremony of the Memorandum of Understanding for the development of the Black Sea Energy submarine cable,” European Commission, December 17, 2022, https://ec.europa.eu/commission/presscorner/detail/en/statement_22_7807.

[70] “2022 Implementation Report,” Energy Community Secretariat, 160, https://www.energy-community.org/implementation/report.html.

[71] “Zelensky signed the Law on REMIT,” Expro Consulting, July 3, 2023, https://expro.com.ua/en/tidings/zelensky-signed-the-law-on-remit.

[72] “Zakon pro REMIT: golovne,” Expro Consulting, July 2, 2023, https://expro.com.ua/statti/zakon-pro-remit-golovne.

[73] “OECD Market Study of the Electricity Sector in Ukraine,” OEAD, June 30, 2023, https://www.oecd.org/daf/competition/oecd-market-study-of-the-electricity-sector-in-ukraine.htm.

[74] “Ministry of Energy: Parliament supported draft law to stimulate development of green energy,” Cabinet of Minsitry of Ukraine, July 1, 2023, https://www.kmu.gov.ua/en/news/minenerho-parlament-pidtrymav-zakonoproekt-shcho-stymuliuvatyme-rozvytok-zelenoi-enerhetyky.

[75] The New Voice of Ukraine, “Ukrainian parliament incorporates Energoatom nuclear operator,” Yahoo! News, https://news.yahoo.com/ukrainian-parliament-incorporates-energoatom-nuclear-203300746.html.

[76] Volodymyr Omelchenko, “Ukraine’s renewable energy sector before, during and after the war,” Razumkov Centre, November 11, 2022, https://razumkov.org.ua/en/articles/ukraines-renewable-energy-sector-before-during-and-after-the-war.

[77] “Cost-Competitive Renewable Power Generation: Potential across South East Europe,” IRENA, January 2017, 80, https://www.irena.org/-/media/Files/IRENA/Agency/Publication/2017/IRENA_Cost-competitive_power_potential_SEE_2017.pdf?rev=7e73f9fadfd744acb2dddcf6f5bd3eab.

[78] Yaroslav Demchenkov, “Wind of change: yaki zminy nese vitrova energetyka Ukraini,” Ekonomichna Pravda, January 6, 2023, https://www.epravda.com.ua/columns/2023/01/6/695729/.

[79] Thomas Laffitte, “Europe’s Energy Transition: Ukraine’s Salvation?” Green European Journal, November 29, 2021, https://www.greeneuropeanjournal.eu/europes-energy-transition-ukraines-salvation/.

[80] “Hydrogen and decarbonised gas market package,” European Commission, https://ceuedu-my.sharepoint.com/personal/laffitte_thomas_phd_ceu_edu/Documents/- https:/energy.ec.europa.eu/topics/markets-and-consumers/market-legislation/hydrogen-and-decarbonised-gas-market-package_en.

[81] Dawud Ansari and Jacopo Maria Pepe, “Toward a hydrogen import strategy for Germany and the EU Priorities, countries, and multilateral frameworks,” German Institute for International and Security Affairs, SWP Working Papers 1, 2023, https://www.swp-berlin.org/publications/products/arbeitspapiere/Ansari_Pepe_2023_Hydrogen_Import_Strategy_WP.pdf.

[82] Ad van Wijk and Jorgo Chatzimarkakis, “2x40GW Green Hydrogen Initiative,” Hydrogen Europe, March 2020, https://hydrogeneurope.eu/in-a-nutshell/reports/.

[83] “In pursuance of the agreements between Volodymyr Zelenskyy and Angela Merkel, a memorandum of cooperation was signed on “green” hydrogen production,” Official Website of the President of Ukraine, August 22, 2021, https://www.president.gov.ua/en/news/na-vikonannya-domovlenostej-mizh-volodimirom-zelenskim-ta-an-70241.

[84] Nikolaus J. Kurmayer, “Ukraine gets compensation in exchange for US-Germany deal on Nord Stream 2,” Euractiv, July 22, 2023, https://www.euractiv.com/section/energy-environment/news/ukraine-gets-compensation-in-exchange-for-us-germany-deal-on-nord-stream-2/.

[85] European Union and Ukraine, “Memorandum of Understanding between the European Union and Ukraine on a Strategic Partnership on Biomethane, Hydrogen and other Synthetic Gases,” https://energy.ec.europa.eu/system/files/2023-04/MoU_UA_signed.pdf.

[86] “Timmermans Recovery Plan for Ukraine,” Hydrogen Europe, https://hydrogeneurope.eu/wp-content/uploads/2023/01/Timmermans-Recovery-Plan-for-Ukraine2-003.pdf.

[87] Ibid.

[88] Alina Aponchuk, “Megavaty vijny: vtraty, zdobytky ta perspektyvy vitroenergetyky v Ukraini,” Eco Rayon, August 5, 2022, https://eco.rayon.in.ua/topics/533793-megavati-viyni-vtrati-zdobutki-ta-perspektivi-vitroenergetiki-v-ukraini.

[89] “Mission Innovation Hydrogen Valleys Platform,” Clean Hydrogen Partnership, https://www.clean-hydrogen.europa.eu/get-involved/mission-innovation-hydrogen-valleys-platform_en#:~:text=A%20%E2%80%9CHydrogen%20Valley%E2%80%9D%20is%20a,the%20economics%20behind%20the%20project.

[90] “EU could help Ukraine launch two ‘hydrogen valleys’,” Ukrinform, April 6, 2023, https://www.ukrinform.net/rubric-economy/3692226-eu-could-help-ukraine-launch-two-hydrogen-valleys.html.

[91] “Hydrogen Ukraine,” H2U, https://h2u.ua/uk/golovna/ ; Claudia Patricolo, “Ukraine gets ready to become the green hydrogen supplier of Europe – interview with Iaroslav Kryl, CEO, Hydrogen Ukraine,” Ceenergynews, September 28, 2022, https://ceenergynews.com/interviews/ukraine-gets-ready-to-become-the-green-hydrogen-supplier-of-europe-interview-with-iaroslav-kryl-ceo-hydrogen-ukraine/.

[92] “New EU-funded project is expected to increase European biomethane potential by 66 percent,” European Biogas Association, April 5, 2023, https://www.europeanbiogas.eu/wp-content/uploads/2023/04/PR-New-EU-funded-project-is-expected-to-increase-European-biomethane-potential-by-66.pdf

[93] “Biogas and Biomethane,” UABIO, https://uabio.org/en/biogas-and-biomethane/ ; “Yulia Pidkomorna ukraina mozhe vyrobliaty do 8 mlrd kub.metriv biometany na rik,” Kabinet Ministriv Ukrainy, March 31, 2023, https://www.kmu.gov.ua/news/yuliia-pidkomorna-ukraina-mozhe-vyrobliaty-do-8-mlrd-kub-metriv-biometanu-na-rik.

[94] “Ukrainian biomethane will become competitive on the European continent,” Ukrainian Hydrogen Council, March 28, 2023, https://hydrogen.ua/en/news/1690-ukrainian-biomethane-will-become-competitive-on-the-european-continent.

[95] “Cooperation for Restoring the Ukrainian Energy Infrastructure project: Task Force Ukrainian energy sector evaluation and damage assessment – X (as of May 24, 2023),” International Energy Charter, May 24, 2023, 11, https://www.energycharter.org/fileadmin/DocumentsMedia/Occasional/2023_05_24_UA_sectoral_evaluation_and_damage_assessment_Version_X_final.pdf.

[96] “RGC Connects the First Biomethane Plant in Ukraine,” Regional Gas Company, 12 April, 2023, https://rgc.ua/en/news/chista-energija/id/rgk-pidkljuchila-pershii-v-ukraini-biometanovii-za-42388.

[97] Aura Sabadus, “Ukraine prepares for biomethane exports to Europe,” ICIS, September 30, 2022, https://www.icis.com/explore/resources/news/2022/09/30/10811126/ukraine-prepares-for-biomethane-exports-to-europe/.

[98] “Ukraine plans to build 10 biomethane plants in two years,” Ukrinform, March 13, 2023, https://www.ukrinform.net/rubric-economy/3681836-ukraine-plans-to-build-10-biomethane-plants-in-two-years.html.

[99] “Ukraine: Legal framework for biomethane treatment,” Baker McKenzie, November 23, 2021, https://insightplus.bakermckenzie.com/bm/projects/ukraine-legal-framework-for-biomethane-treatment.

[100] “Minfin ta Mineenergo ne stvoryly umovy dlya eksportu biometanu – golova Bioenergetychnoi asoziazii,” Ukrinform, April 7, 2023, https://interfax.com.ua/news/press-conference/902638.html.

[101] “V Minsiterstvi Energetyky rozrobleno try bazhluvukh dokumenty dlya pidgotovky Vodneboi Strategii Ukrainy,” Kabinet Ministriv Ukrainy, April 21, 2021, https://www.kmu.gov.ua/news/v-minenergetiki-rozrobleno-tri-vazhlivih-dokumenti-dlya-pidgotovki-vodnevoyi-strategiyi-ukrayini; “Minenergo zavershylo obhovorennya Vodnevoi strategii – Yulia Pidkomorna,” Kabinet Ministriv Ukrainy, September 27, 2022, https://mev.gov.ua/novyna/minenerho-zavershylo-obhovorennya-vodnevoyi-stratehiyi-yuliya-pidkomorna.

[102] Bohdan Zayika, “Velyke atomne budivnytstvo: v Urkaini pobiduyt‘ sche 14 energoblokiv. De, koly i za skilky?,” Liga Business, November 23, 2021, https://biz.liga.net/ua/ekonomika/tek/article/bolshaya-atomnaya-stroyka-v-ukraine-postroyat-esche-14-energoblokov-gde-kogda-za-skolko.

[103] “Ukrainian nuclear plants are ‘ready for safe operation’, Energoatom chief says,” Nuclear Newswire, February 24, 2023, https://www.ans.org/news/article-3692/ukrainian-nuclear-plants-are-ready-for-safe-operation-energoatom-chief-says/.

[104] “Kraina realnykh reaktoriv,” Ekonomichna Pravda, December 8, 2021, https://www.epravda.com.ua/publications/2021/12/8/680476/.

[105] “US-Ukrainian energy partnership foresees five new reactors,” World Nuclear News, 01 September 2021, https://world-nuclear-news.org/Articles/US-Ukrainian-energy-partnership-foresees-five-new; “Westinghouse and Energoatom expand plans to nine AP1000 units,” World Nuclear News, June 6, 2022, https://world-nuclear-news.org/Articles/Westinghouse-and-Energoatom-expand-plans-to-nine-A.

[106] Ibid.

[107] “US Eximbank tentatively agrees on amount of financing for construction of two power units at KHNPP – Energoatom head,” Ukraine Open for Business, November 21, 2021, https://open4business.com.ua/en/us-eximbank-tentatively-agrees-on-amount-of-financing-for-construction-of-two-power-units-at-khnpp-energoatom-head/.