Williams has found an enthusiastic cheerleader to help guide natural gas opportunities into the future with Chad Zamarin.

The recently promoted executive vice president oversees Corporate Strategic Development for the natural gas pipeline behemoth. Zamarin sat down with NGI at CERAWeek by S&P Global to discuss what’s ahead at Williams. He also chairs the Interstate Natural Gas Association of America (INGAA).

Fresh from a roundtable with a diverse group of Republican and Democratic policy makers, Zamarin discussed the opportunities and the challenges facing the natural gas industry. The group has formed Natural Allies for a Clean Energy Future to educate people on the “power of natural gas,” he said.

“The dream we all share is very inspiring,” he said. “But you have to figure out how to match that to what we can accomplish to get practical ways to move our progress toward it.”

In his role at Williams, Zamarin is the brains of enterprise-level strategy, business development and customer-relationship management. Zamarin also helms commodity marketing, upstream joint ventures, new energy ventures, communications and corporate social responsibility.

It’s a lot. Zamarin, though, thinks there’s never been a better time to be in the natural gas business.

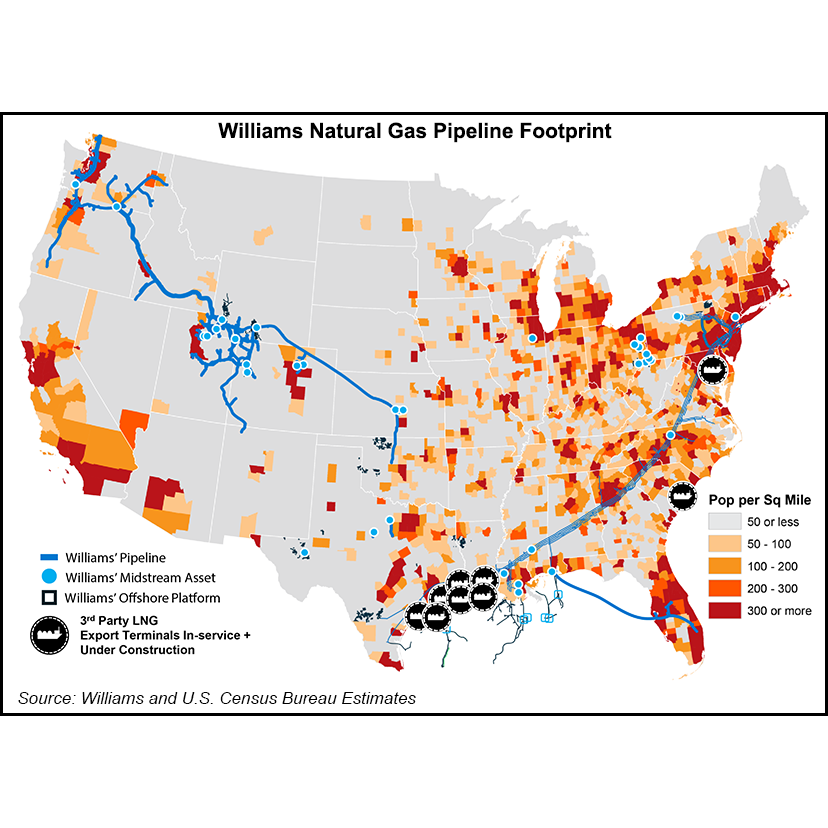

“Williams…moves about a third of the nation’s natural gas,” he noted. “We are very focused on the natural gas value chain. It’s pretty much all that we do.”

The Tulsa-based pipeline giant has evolved since it was formed more than a century ago.

“The company has been entrepreneurial. It’s innovative…We weren’t doing the same thing in 1920 that we’re doing in 2023. And we…likely won’t be doing the same thing in 2123.”

His job is to focus on “making sure we understand the markets, the market fundamentals” and the opportunities.

Renewables ‘Accelerator’

“We need to focus on how natural gas can be an accelerator for renewables,” Zamarin said. “It’s necessary for electrification and will continue to displace dirtier fuels…”

As a top strategist, Zamarin’s role is to look toward the “next generation of opportunity. A company like ours…wants to be a relevant part of the solution for generations to come. There are things that we need to be thinking about today that might help move the needle 10 or 20 years from now.”

As part of that effort, the New Energy Ventures group was launched in 2021 as Williams targets net-zero carbon by 2050. Certified natural gas ventures, carbon capture and storage, and other technologies including hydrogen all are on the table.

“We call it NextGen Gas,” basically ways to “decarbonize the existing value chain,” Zamarin said. “I spend a lot of my focus in those areas.”

Williams defines NextGen Gas as natural gas that is independently certified as having low emissions across all segments of the value chain. The term goes beyond “responsibly sourced,” which is natural gas that has been verified at the production site as meeting certain environmental standards and practices.

Value Up

To extend the scope of the full-value chain, Williams executed agreements late last year with upstream producer Coterra Energy Inc. and downstream utility Dominion Energy Virginia. The agreement is designed to deliver certified gas from the wellhead to Dominion through this year.

Williams and Appalachia-focused PennEnergy Resources LLC last year also agreed to deliver NextGen natural gas to market. The agreement includes an independent, third-party certification process.

“Our focus is on making sure that we can create the most efficient natural gas value chain all the way from wellhead to water,” Zamarin said, referring to potential LNG exports. “We gather a lot of gas,” much of which is destined for liquefied natural gas export.

“We deliver to every major LNG terminal in the U.S.,” Zamarin noted. “And what we’ve been doing is better integrating that value chain…”

To expand natural gas sales expertise, Williams bought Sequent Energy Management LP from Southern Company. To extend its credibility, Williams invested in Context Labs to provide end-to-end emissions data for certified natural gas that it transports, initially from the Haynesville Shale. The company also is investing in satellite sensor technology.

“Our goal is to shine a very credible spotlight on the natural gas value chain so we can actually take gas into our system, track that gas through our system, and deliver it to LNG terminals and certify, with credibility, the emissions profile of that energy and then show how we’re driving that down over time,” Zamarin explained.

No Trivial Pursuit

The costs to verify and certify the gas is “not trivial,” Zamarin said. “The software alone is a major cost…We’re changing the way natural gas and energy is sourced and delivered today. It’s the evolution. It’s almost taking the entire grid. It’s the smart grid technology.”

Williams also is “actively working with all of the LNG offtakers,” he said. “They are there if you can bring in high-fidelity products, where you can use direct measurement and you can actually certify with credibility.”

KPMG is auditing the systems too. “It is a significant investment. But we’re seeing the market value.”

Asked how to ensure parity across the value chain, Zamarin said, “I think the market will drive that. I think that a rising tide lifts all ships. I think it’s fairly nascent right now. We’ve done some transactions. We’ve implemented the technology in certain initial areas…”

The goal by the end of this year is “to have this capability cast across our entire network and then continue to add…We’ll be launching satellites this year, add additional sensor technologies, so we will continue to increase the fidelity of the system,” Zamarin said.

“I’m convinced the entire market will evolve. But I do think there’s going to be some that are going to get there faster. I think the market is going to differentiate those who do, and others will have to catch up.”

More Natural Gas For Renewables?

Williams CEO Alan Armstrong also was at CERAWeek. He indicated that there had been a nearly 85% increase in renewables near the Northwest Pipeline, which serves the Pacific Northwest.

As renewables have expanded in the Northwest, “we’ve seen peak demand increase on our systems…Natural gas is going to absolutely be critical to accelerate renewables and to enable electrification.”

Natural gas is replacing coal and driving down emissions. However, because renewables are intermittent, “the more that we take other energy sources off the grid, we’re more reliant on renewable energy,” Zamarin said. “When you have periods of time when the sun isn’t shining all day long, when the wind slows down, natural gas is that balancing source.”

For example, Texas has more wind power than anywhere else in the country. Because of the fluctuation of wind, though, the “only way the Texas market works is that natural gas picks up the slack when the wind slows down. And we are that balancing power source. When you put more renewables in, those swings will be bigger.”

Some areas of the country are attempting to phase out the use of natural gas, including California. Asked if the state needed to reverse its stance and add in more gas, Zamarin was clear.

“I think they’re seeing it,” he said, noting the massive price spikes across the state. “That’s a big part of why we’re so focused on delivering the message about natural gas…”

In the last year, “the signs of the instability that are coming into the market have just started really showing up in greater focus…We had coal and gas switching, and that can help you balance things. But if we look at our system over the last 12 months, we saw price dislocations in the Rockies, in the western part of the United States.

“If you look at the supply of energy, other than renewables, all of the supply of gas is east of the Rockies. So we’re now seeing the signs that California and the West are going to need more infrastructure.”

If the western part of the country wants to continue “electrifying, and they want to keep adding renewables, you’ve got to have that gas backup to make that possible. I think people are starting to wake up to that.”

Customers “don’t want to pay $50 in an emergency when it is literally on our system, under a 50-mile difference.” Gas hit $55/Mcf in the Rockies at one point. “That tells you that this market needs more supply, and all you need to do is increase the infrastructure.”

How To Convince Regulators?

Zamarin chairs the INGAA and serves on the Department of Transportation’s Gas Pipeline Advisory Committee. Building out pipeline infrastructure is necessary, but how do operators convince lawmakers and regulators?

“At the end of the day, we’re trying to educate folks on again, natural gas and the powerful decarbonization here,” Zamarin said. “The world last year burned more coal than in any year in the history of the planet. One amazing statistic: we have just over 200 coal plants still operating that make about 20% of our power.” he said.

“Still, last year, China approved almost 200 new coal mining stacks. With all the great things we’ve done in the U.S. to reduce emissions, China now burns five times more coal than the United States.”

The United States, Zamarin noted, “has the gas supply…It’s low cost, affordable, reliable and decarbonized by displacing emissions…It is not ‘do we have the resource?.’ The issue is, can you get the resource from where it is to where it’s needed, whether that’s a coal plant in the U.S., whether that’s from England, which is burning fuel oil this winter.

“That’s not a resource issue,” he said. “It’s an infrastructure issue. I do feel like we’re gaining traction. It appears that there’s real motivation to do something with earning from going to Congress and that it’s going to be necessary for renewables as well, and the amount of electric transmission we need to build.”

In addition, Zamarin said the Federal Energy Regulatory Commission “appears to be more functional with acting Chair Willie Phillips taking on a leadership role…I’m optimistic…”

Zamarin said his enthusiasm is not because he works for Williams or that he is in the energy industry.

“I look at my kids, and I want to work on something that has a positive impact. I want our employees to believe and know that they’re working on something that has a positive impact. So I think we have got to do a better job of educating how, if you want a practical solution, we can focus on emissions – not on the source.”

The facts show, he noted, that emissions can be driven down in natural gas. “We can continue to use it at home and around the world. And then we also can be exploring those next technologies, like hydrogen, where we can leverage our skills.”